How to use TradingDiary Pro as a portfolio management software

By default after importing your transactions all of your trades/positions are assigned into an account. You might manage funds or investments of your broader family or you just simply want to separate the positions on your accounts into several portfolios. Another scenario could be that you buy 1000 MSFT but these shares belongs to several portfolios. This is when TradingDiary Pro’s portfolio management feature comes into the picture.

Virtual accounts as an individual portfolio

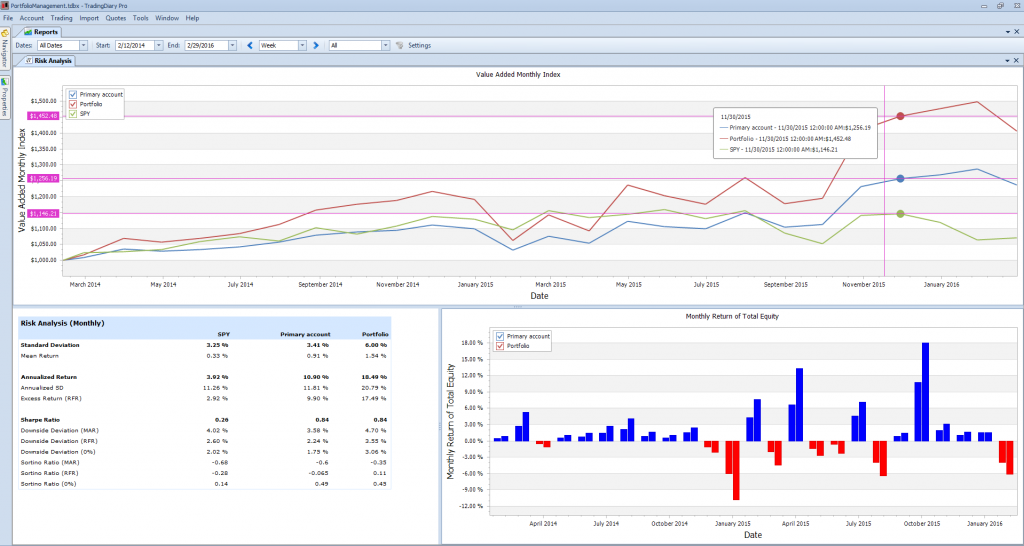

You can create virtual account (named portfolio) in the software which will act as a separated portfolio. You can track as many portfolios as you want. A portfolio can have its own cash transactions for example initial deposit. You can allocate positions (from 1% to 99% of it) from a real account into a portfolio. After setting an initial deposit for your portfolio and allocating positions from a real account you can generate the net asset value history of that particular portfolio. This means that you can monitor your portfolio’s all supported performance metrics including Sharpe ratio, Sortino ratio, Internal Rate of return, Time Weighted rate of return, Monthly value added index and so on. Let’s check the whole process step by step.

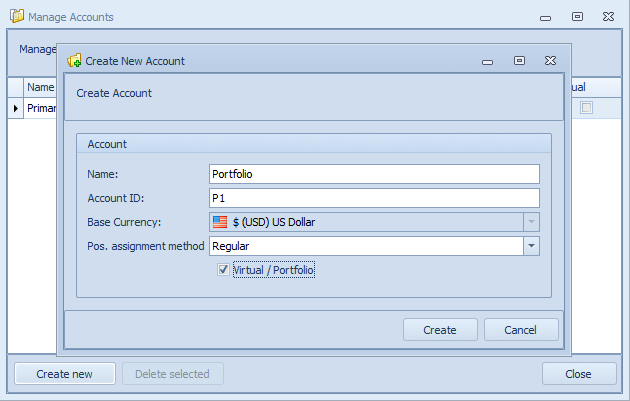

Creating virtual account.

Assuming you have set your database and transactions have been imported or added manually.

First you have to create the virtual account/portfolio. To do so please click on the Account/Manage menu and click on the Create new button. Set the name, the account id and tick the Virtual/Portfolio check box.

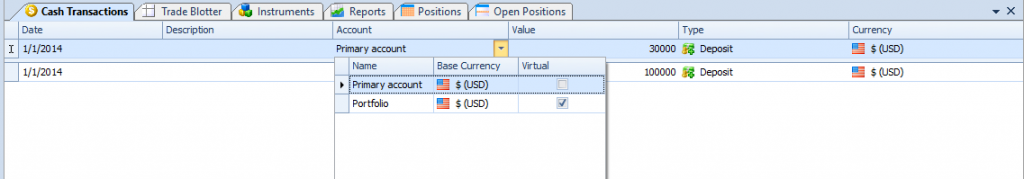

The next step is set an initial deposit for your newly created virtual account. This is optional but it is vital for generating equity history. Please note the initial deposit date must be earlier than the first trade’s date.

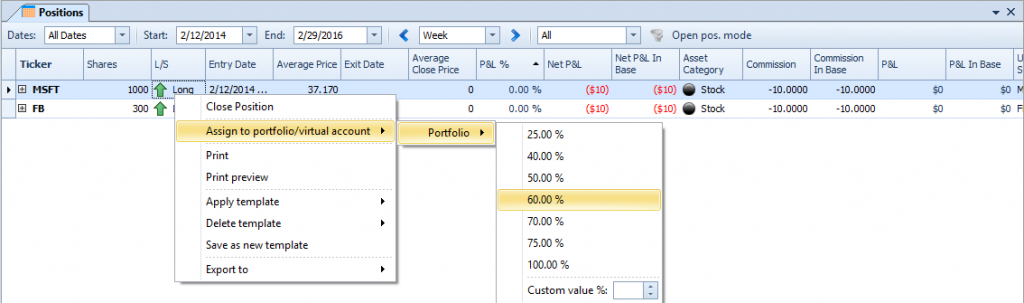

Assigning positions

The following step is to assign/allocate positions into your newly created portfolio. All you have to do is open the positions view, select the positions which you’d like to assign and right click on it.

You can select from the predefined percentage of values or you can enter a custom value from 1% to 100%. After you have assigned the position to a portfolio you can filter for that particular portfolio. The software automatically creates a filter for each portfolio accounts.

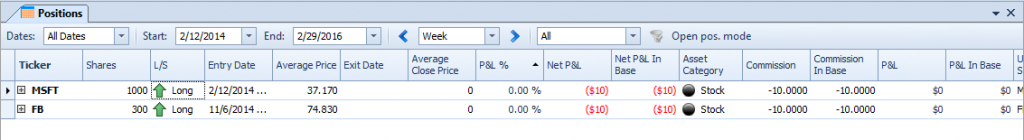

All positions of our demo database.

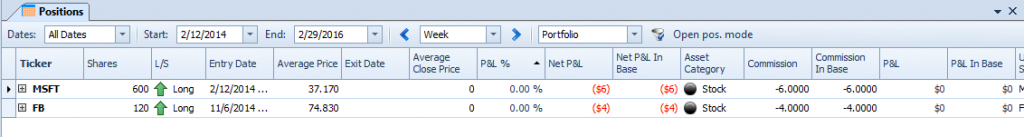

Filtered down to the previously defined portfolio. The allocations are MSFT 60%, FB 40%.

As you can the Shares, the P&L and the commissions are adjusted by the allocations.

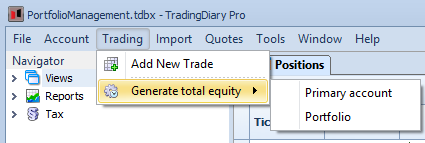

The last step is to generate the equity history for that particular portfolio. To do so click on the Trading/Generate total equity.

The end result is that you can check all of the risk metrics of your portfolio. Risk analysis of SPY (benchmark), primary account and the portfolio account.

You can download this database by clicking on this link. Please save it to a write enabled folder otherwise you can’t open it.

If you would like to check how it works live in the software you can download the database from here. Please do not open it from the web browser. Save the file first, start TradingDiary Pro and open the file from it.