Options Trading Journal

One of the unique features of TradingDiary Pro—unmatched by any other trading journal software—is its support for options strategies. With TradingDiary Pro, you can effectively track your stock and futures options strategies.

What Is an Options Strategy?

An options strategy involves simultaneously buying or selling one or more options that differ by variables such as strike price, expiration date, or moneyness. The goal is usually to control risk while maximizing returns.

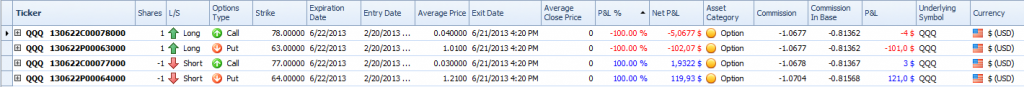

A typical strategy may include several individual positions, often called “legs,” which are naked options. A classic example is the Iron Condor: four naked options with the same expiration date but different strike prices.

For instance, if QQQ is trading at 70.5, an Iron Condor might include:

- Buy June 78 Call

- Sell June 77 Call

- Sell June 64 Put

- Buy June 63 Put

Using an Options Trading Journal

1. Identifying a Strategy

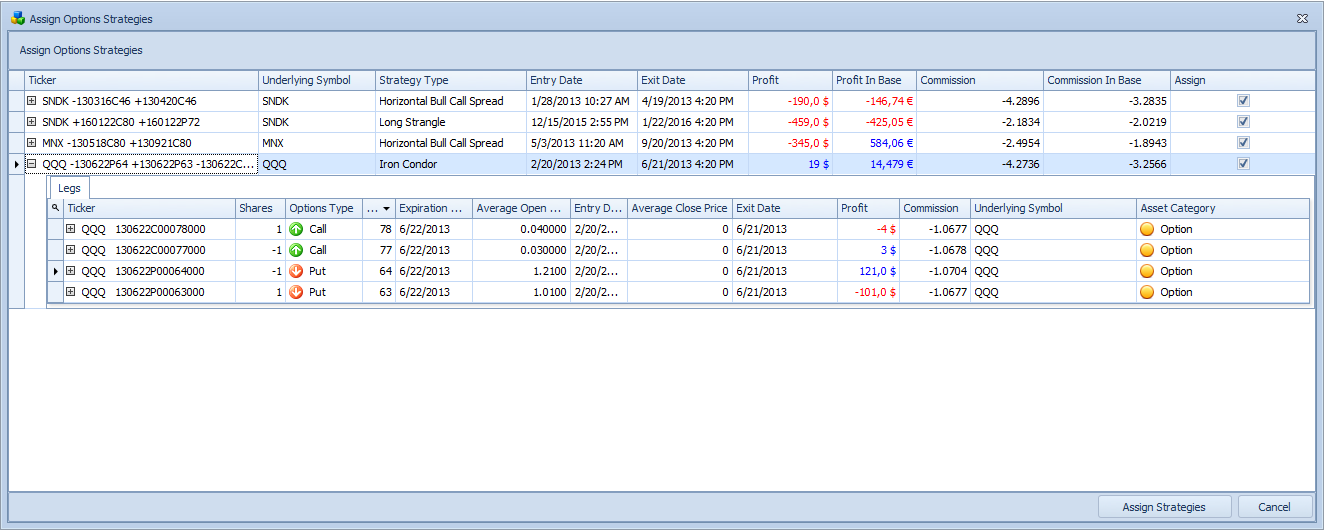

By default, importing trades creates separate positions for each of the four legs, each with its own P&L. This can make it difficult to track the overall performance of your strategy. TradingDiary Pro resolves this by scanning your positions and intelligently grouping them as a cohesive strategy.

You can assign legs to a strategy using two methods:

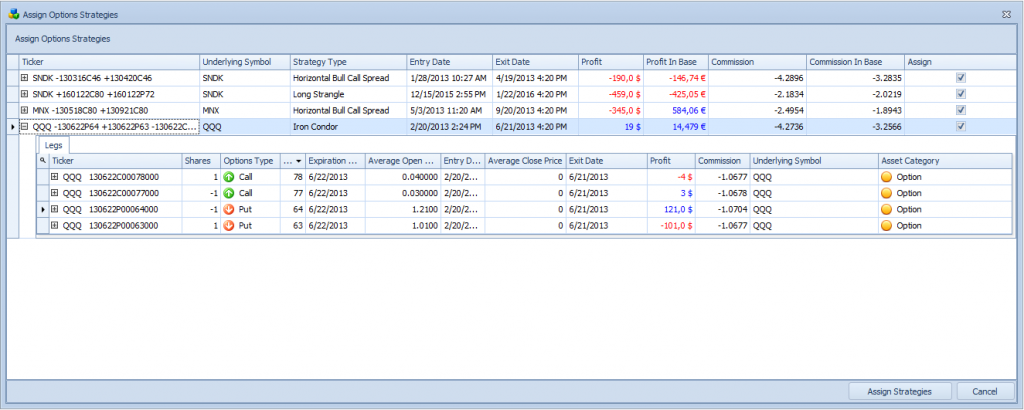

a) Via the menu

- Navigate to Tools → Assign Options Strategies

- The software lists detected strategies—check those you want to combine

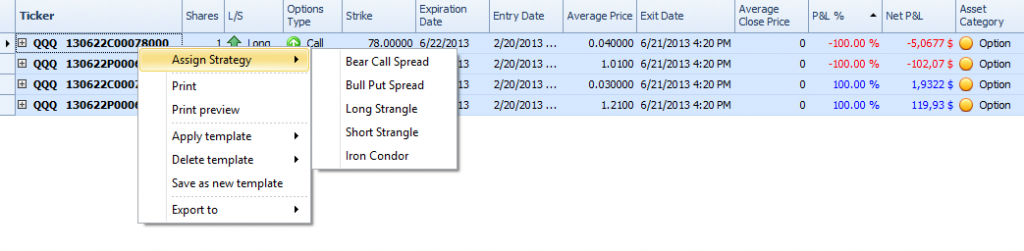

b) Via right-click

- Select multiple positions that form a strategy

- Right-click to access Assign Strategy if applicable

2. Supported Strategies

TradingDiary Pro supports over 20 options strategies, including:

- Horizontal Bull/Bear Call/Put Spreads

- Bear/Bull Call/Put Spreads

- Diagonal Call/Put Spreads (both Bullish/Bearish)

- Long/Short Straddle

- Long/Short Strangle

- Long Call/Put Butterfly

- Iron Condor

- Covered Call/Put

- Box Spread

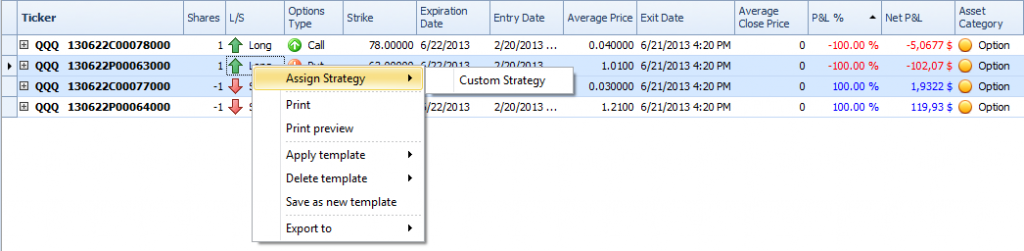

You also have the flexibility to define custom spread strategies. Simply select at least two naked options in the Positions view (Ctrl‑click), right‑click, and choose Custom Strategy.

3. Strategy Adjustments

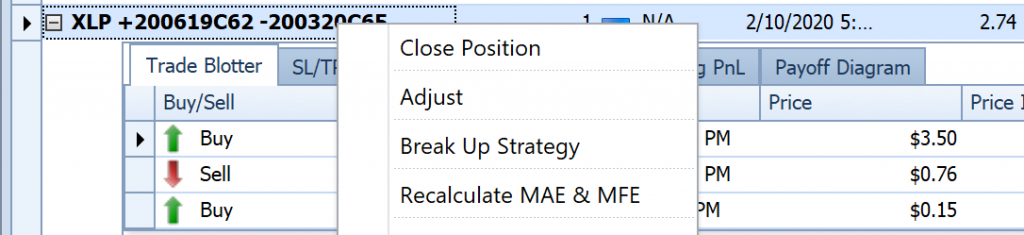

When market conditions shift, adjustments may be necessary. To update a strategy:

- Select the combined strategy in the table.

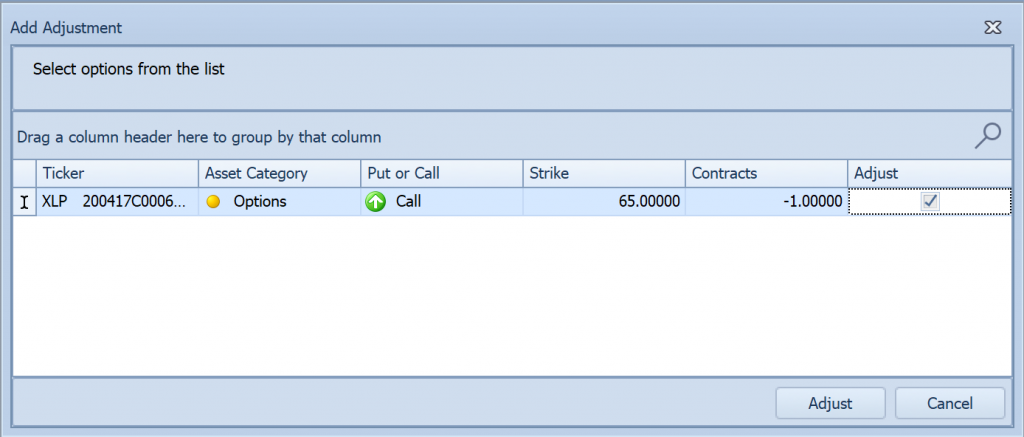

- Right-click and choose Adjust (this option appears only if adjustment candidates exist).

- In the pop-up, tick the box next to the additional leg(s), then click Adjust.

- The new leg(s) integrate into the strategy, and all position metrics (including P&L) are recalculated.