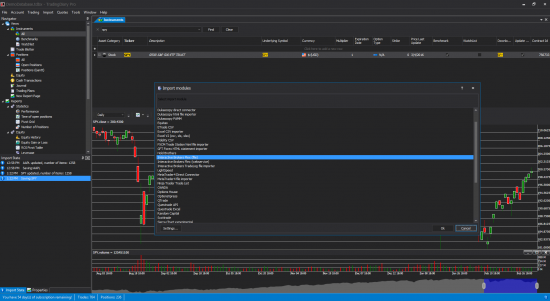

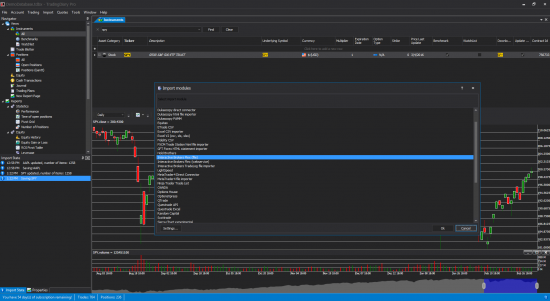

Import / Data input

- One-click automated import for several brokerage firms

- Lot of semi-automated importers via excel or csv files

- Manual data input

Import modules

As you can see in the Screenshots section TradingDiary Pro has bulk import functionality. The following table shows the supported brokers.

| Online broker | Trades | Current net asset value | Net asset value history | Cash transactions | Orders (stops and targets) | Last price information |

|---|---|---|---|---|---|---|

| Advantage Futures | yes | no | no | no | no | no |

| Ally | yes | no | no | yes | no | no |

| Apex Clearing | yes | no | no | yes | no | no |

| Bell Direct | yes | no | no | no | no | no |

| Cap Trader (via Interactive Brokers import module) | yes | yes | yes | yes | no | yes |

| Charles Schwab | yes | no | no | yes | no | no |

| Commonwealth Securities | yes | no | no | no | no | yes |

| Degiro | yes | no | no | no | no | no |

| ETrade | yes | no | no | yes | no | no |

| Fidelity | yes | no | no | yes | no | no |

| FXCM | yes | yes | no | yes | yes | yes |

| GFT Forex | yes | no | no | no | yes | no |

| Interactive Brokers | yes | yes | yes | yes | no | yes |

| KBC Equitas | yes | no | no | no | no | no |

| MetaTrader4 | yes | yes | no | yes | yes | yes |

| NinjaTrader | yes | no | no | no | no | no |

| OANDA | yes | yes | no | yes | yes | yes |

| Rithmic | yes | no | no | no | no | no |

| Scotia iTrade | yes | no | no | no | no | no |

| Scottrade | yes | no | no | yes | no | no |

| Sierra Charts | yes | no | no | no | no | no |

| Stage5Trading | yes | no | no | no | no | no |

| Tastyworks | yes | no | no | no | no | no |

| Thinkorswim | yes | yes | no | no | yes | no |

| TD Ameritrade | yes | yes | no | no | yes | no |

| Trade Monster | yes | no | no | no | no | no |

| TradeStation | yes | no | no | no | no | no |

| QTrade | yes | no | no | no | no | no |

| Questrade | yes | yes | no | yes | yes | yes |

| WH Selfinvest | yes | no | no | yes | no | no |

| Zaner/Infinity Futures | yes | no | no | no | no | no |

| Excel CSV | yes | no | yes | yes | no | no |

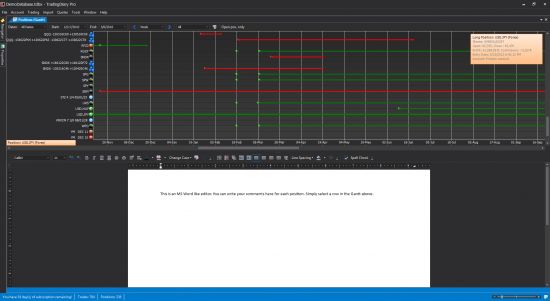

Trading Journal

- Each position has an attached word like document

- Master journal for non-trade related notes

- Combined journal of positions

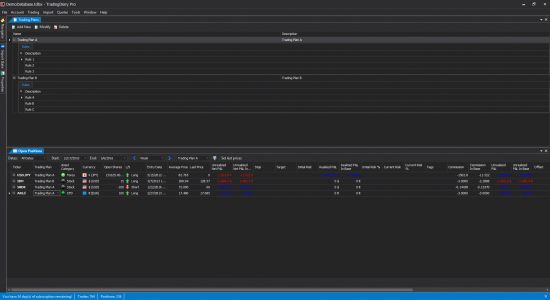

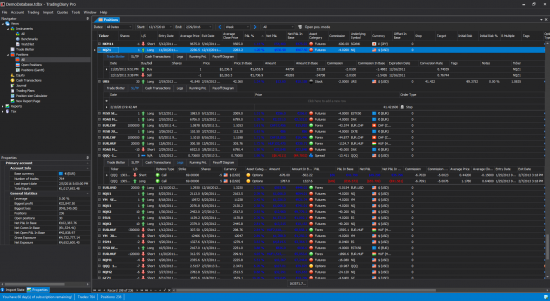

Trade/Position accounting

- Supports multiple accounts

- Supports multiple portfolios via virtual accounts and custom allocation of real trades to a portfolio

- Multi-currency support. Handling trades in foreign currency with conversion rate. The software calculates the PnL in base and in the trade currency

- Generation of Net Asset Value (Total Equity) based on the positions and historical data

- Storing data for cash transactions (broker and data provider fees, dividend, interest paid and received)

- Adding modifiers(dividend, payment in lieu of dividend, interest etc.) to positions for better view of real profit or loss

Tags

- Tag your trades with as many tag as you want

- Filter for tags to drill down the performance of each strategy

- Maintain existing tags with deleting or renaming one

Historical Data download modules

- Interactive Brokers

- MetaTrader 4

- FXCM API based

- OANDA

- Questrade

- Yahoo finance

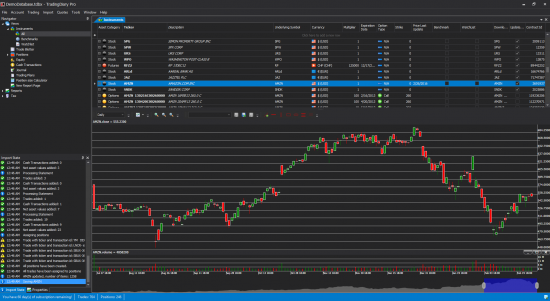

Price charts

- Fully featured stock chart module

- More than 100 indicators and chart studies

- Plot trades on chart

Filter positions and generate reports by

- Tags

- Trading Plans

- Accounts

- Portfolios

- Underlying symbol

- Ticker

- Long or Short

- Asset Categories

- Profit or Loss

- Currencies

- Duration

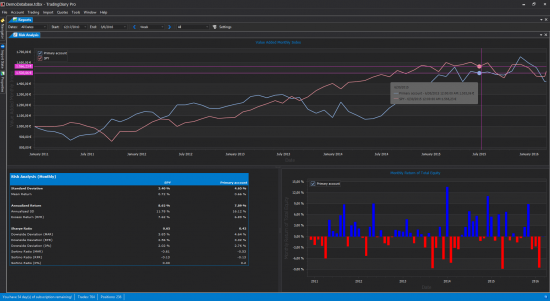

Post modern portfolio theory risk metrics

- Sharpe ratio

- Sortino ratio

- Compare your account, portfolio to benchmarks

- Value added weekly and monthly index

- Standard deviation

- Annualized return

- Excess return

- Downside deviation

- All metrics can be annualized weekly, monthly and yearly based on the given risk free rate and minimum acceptable return

Stop and target based risk metrics

- Initial risk

- Initial risk percent to total equity

- Current risk

- Current risk percent to total equity

- Risk / Reward

- Calculating average risk

- Calculating average risk percent to total equity

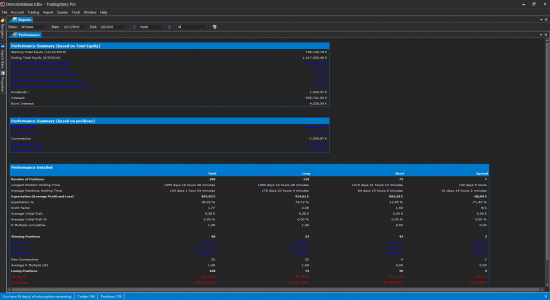

Performance management

- Calculating Internal rate of return

- Calculating Time weighted rate of return

- Winning and losing positions

- Winning and losing percentage

- Average profit and loss

- Gross profit and loss

- Max consecutive wins and losses

- Expectation

- Expectation %

- Profit Factor

- Average R Multiple

Net asset value (Total Equity) based reports

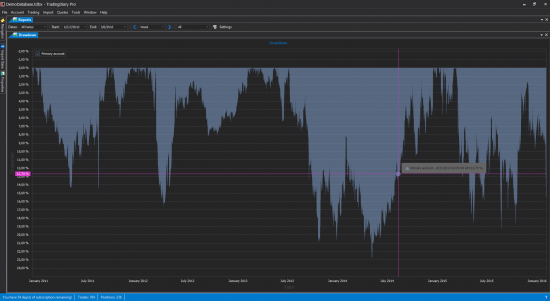

- Equity curve

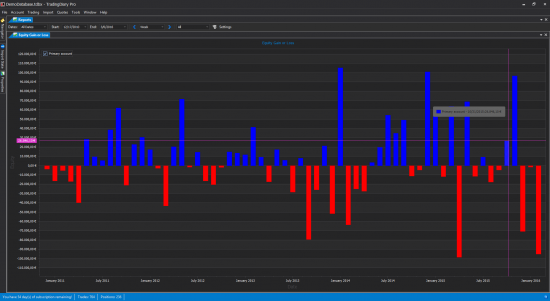

- Equity gain or loss in daily, weekly, monthly, quarterly and yearly resolution

- ROI (return on investment) Pivot Grid

- Leverage. Calculating leverage based on net asset value and the total amount of positions

- Drawdown

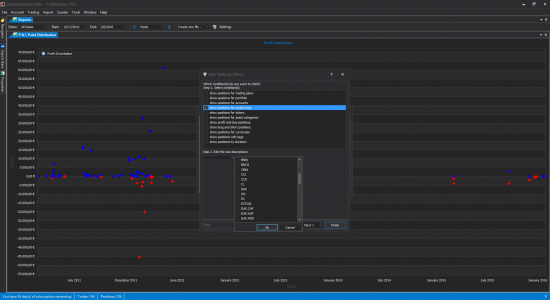

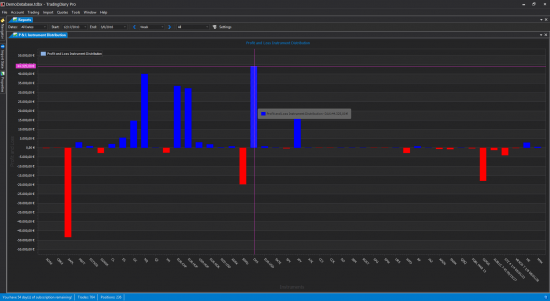

PnL reports based on closed positions

- Cumulative in daily, weekly, monthly, quarterly and yearly resolution

- Distribution

- Time distribution

- Instrument distribution

- Point distribution

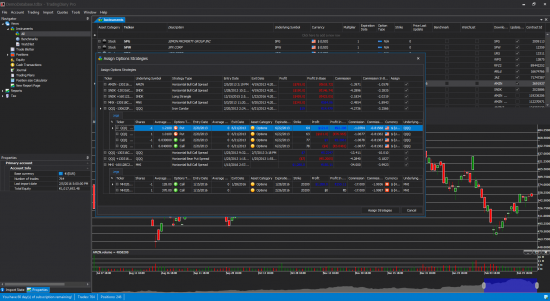

Options strategy handling

- Recognizing more than 25 options strategies like all vertical, horizontal and diagonal spreads, Condors, Straddles, Strangles, Collar, Covered Call and Covered Put

- Adjustment support

- Custom strategy support

- Futures options handling

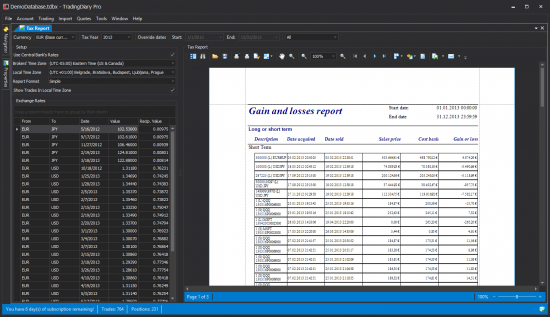

Tax Reports

- Capital gains report

- Support non-base currency tax report

- Downloading exchange rates from Central Banks based for proper handling of non-base currency trades. Currently AUD, CAD, EUR, HUF and PLN are the supported currencies.

- Dividend report

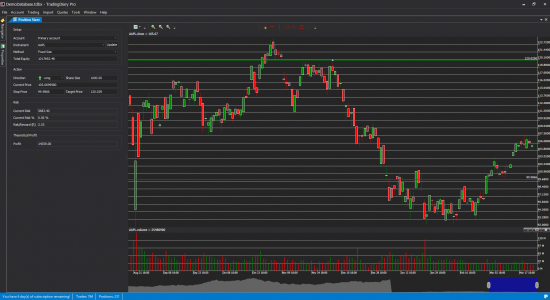

Position Sizer

- Chart based position sizer

- Drag and drop stop and target lines

- Calculates Current Risk, Current Risk %, Risk Reward and theoretical profit

- Three different position sizing methods: Fixed size, Fixed amount and Percent of risk